Maximizing Profit Margins With Strategic Financial Insights 3458058034

Maximizing profit margins requires a meticulous examination of financial data and its implications for operational efficiency. Businesses must adopt cost management strategies while leveraging targeted marketing to bolster revenue. This analytical approach not only enhances resource allocation but also fosters a culture of financial literacy within teams. Understanding these dynamics is essential, yet many organizations overlook critical aspects that can significantly influence profitability. Exploring these nuances may reveal strategies that have remained untapped.

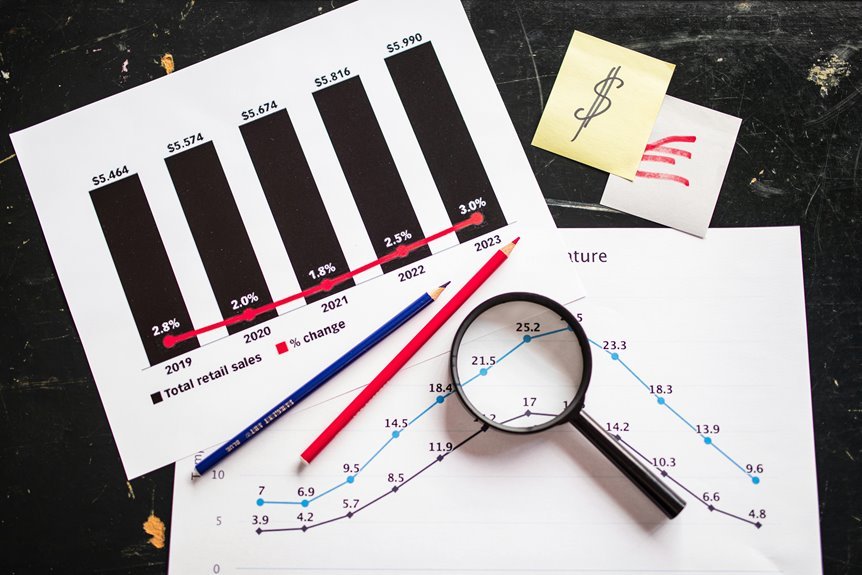

Understanding Financial Data and Its Impact on Profit Margins

While many businesses focus on revenue generation, understanding financial data is crucial for maximizing profit margins.

Financial ratios provide insights into operational efficiency and cost management, essential for informed decision-making.

Additionally, effective revenue forecasting enables businesses to anticipate market trends and adjust strategies accordingly.

This data-driven approach empowers organizations, fostering a culture of financial literacy that ultimately enhances their profitability and operational freedom.

Key Strategies for Enhancing Profitability

Analyzing financial data reveals that enhancing profitability requires a multifaceted approach.

Key strategies include cost reduction through efficient resource management and streamlining operations, alongside revenue enhancement via targeted marketing and product diversification.

Tools for Analyzing Financial Performance

Effective financial performance analysis relies on a suite of specialized tools designed to provide clear insights into a company’s fiscal health.

Key among these are financial ratios, which offer comparative metrics, and performance metrics that assess operational efficiency.

Utilizing these tools enables businesses to identify strengths and weaknesses, facilitating informed decisions that enhance profitability and foster a culture of financial freedom.

Implementing Data-Driven Decision Making

Financial performance analysis not only highlights areas for improvement but also lays the groundwork for implementing data-driven decision making.

By employing robust data analysis techniques, organizations can develop decision frameworks that enhance strategic choices. This approach empowers leaders to leverage insights, optimize resource allocation, and ultimately maximize profit margins.

Data-driven strategies enable agile responses to market dynamics, fostering a culture of informed decision-making.

Conclusion

In the quest for profitability, businesses resemble skilled navigators charting a course through turbulent waters. By harnessing the compass of financial data, they can identify hidden currents and avoid potential pitfalls. Strategic insights act as the wind in their sails, propelling them toward more efficient operations and enhanced revenue streams. As teams cultivate financial literacy, they become the sturdy vessel, ensuring that the journey toward maximized profit margins is not only successful but also sustainable in the long run.